Reverse Investment Pitching is Pointless, Even if It Would Be Brilliant.

Published Date:

- October 20, 2025

Company founders pitch investors to get funding and other help for their business idea. Reverse pitching turns the tables: the investors, business angels and VC’s apply to the startup entrepreneurs to be allowed to invest in their companies.

Is this a good idea? No and yes ☺

The idea sucks - because reverse VC pitching is not reality.

The founder is looking for money. Of course, he says that he is also looking for a network, market access and experience. But let’s be honest, startups need financial resources to reach the PMF or to develop further, to open up markets, to grow or simply to establish the company.

The startup is looking for money and the investors have it, period. It is therefore the most natural thing in the world for startups to seek the favor of investors and not the other way around. The roles are clearly defined and they are clear and understandable for all parties.

However, this has some serious disadvantages.

Not every top salesperson is someone who can build a sustainably successful company. Not every engineer is also a gifted communicator or enthusiast.

The figures show that even the venture industry is not immune to pied pipers.

Reverse investment pitching would be particularly genius for Europe 🗺️

Because it could address one of the biggest weaknesses of the European investor industry, especially when we compare ourselves with the VC nation USA.

The weakness being: investors in Europe, as in Switzerland, are suffering in many areas. With its huge market, the USA is ahead of us in many ways and the 600K patent applications per year are also impressive. We in Europe are spread over 30+ countries and we ‘only’ file 200K patents per year (2023). This also means that our investor markets are fragmented, we have at least 30 start-up regions, in fact there are many more! If I look at Germany, there are an incredible number of start-up scenes in Berlin, Munich, Frankfurt, Darmstadt (Cybersecurity), Hamburg, etc.! [1]

But in addition to the fragmentation, there is another, much more significant European weakness: most of the professional investors or VC fund managers I know have a background in the financial industry. It feels like 4 out of 5 European investors are former bankers and not entrepreneurs! Sorry to say, but bankers have little idea of how to build a company. Dear entrepreneur, do you really want a person on the Board of Directors who has no entrepreneurial skills and no market know-how? Rather less, don’t you?

And this is exactly where reverse investor pitching would help:

A founder would quickly realize whether the investor sitting opposite him is a pure financial manager who only brings money and has no other merits.

That’s why reverse VC pitching would be brilliant, but in the end it’s the investor who gives the money and not the other way around. It is all the more disappointing for the founder if he finds a favorite investor who then tells him, ‘Sorry, but I don’t have a photo for you today…’.

Kein Foto Heidi Klum GIF, tenor

When investors are queuing up: of course there are exceptions! 🦄

Of course, as in every market, there are the high-flyers that also exist in the startup VC market: if you are called Climeworks, SOPHiA, Deepdrive, Mushlabs, Dcubed, tozero or Helsing, then everyone wants to invest anyway; I assume that with these startups it is the VCs who apply to the founders and not the other way around.

And what about

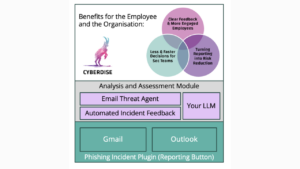

Well, let’s be honest: we were founded less than 2 years ago, we now have over 80K licenses under contract in 6 countries and already have a 6-digit turnover and yes, we are looking for capital. But we are very young and therefore still little known. That’s why it’s very clear that we’re trying to pitch to investors – and not the other way around. That’s why we’re looking forward to Bern startup days 2025 all the more!

Are you interested? Then get in touch with me ☺ https://sud25.startupdays.ch/participations/491570

[1] Berlin für DigitalWirtschaft, Saas, Ecommmerce und KI; München für Mobility, Health, DeepTech und Industrie; Hamburg für Medien E-Commerce;Frankfurt / Darmstadt für Fintech, Insurtech und Cybersecurity und dann noch Köln, Leipzig, Nürnberg, Karlsruhe und gar Oldenburg (BioTech)

We’re excited to share more cybersecurity insights, news, and updates with you in the upcoming editions of this newsletter. However, if you don’t find this helpful, we’re sorry to see you go. Please click the unsubscribe button below.